We all dream of becoming “financially independent.”

The dreams are unique to each individual and often change over the course of a lifetime. To become financially independent, you need to stay financially fit.

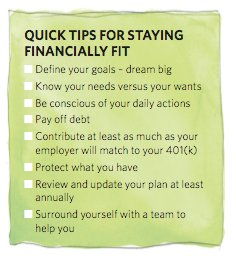

And, like any fitness program, you need to define your goals, develop a strategy, stay conscious of your daily actions and work hard to stay on track.

Women especially need to take control of their finances—independent of their husbands—at every life stage to maintain financial fitness. Life has a way of throwing us curve balls, and this knowledge helps us all roll with the punches

Using these basic principles will help you get started on a financial fitness program, regardless of your income level or life stage:

Quantify your basic monthly needs. Subtract the monthly cost from your monthly after-tax income. The excess is “savings.”

Identify and document your goals. It’s okay to dream big. If you are in a relationship, talk about your plans for the future with your partner. Determine what compromises need to be made by each of you to achieve your goals – together.

Develop an action plan.

Incorporate a budget into your plan and daily routine. This will help you stay out of debt. If you are already in debt, make paying it off a priority.

Contribute to your employer’s 401(k) plan. If your employer offers a match up to a certain percentage, contribute at least that amount if you can. Help protect your income and your family with life and disability insurance.

Reassess your plan annually or when you experience a major life event.

IF YOU ARE AT A LOWER INCOME LEVEL … Focus on increasing your income by working to develop your skills and grow in your career through continuing education as well as learning and development opportunities offered through your employer. Regardless of your income level, term life insurance can be an affordable way to help provide financial protection for your family.

IF YOU ARE AT A MEDIUM INCOME LEVEL …You have more fl exibility and options. At this stage, you may have the additional funds to begin an investment strategy. When choosing how to invest, consider your investment objectives, time horizon, tolerance for risk, personal investment experience and overall financial situation. Once you do this, you will be in a better position to determine the types of investments best suited for your specific goals and objectives.

IF YOU ARE AT A HIGHER INCOME LEVEL …Consider more advanced financial protection and investment strategies, such as estate planning, to preserve your wealth for future generations. Don’t rely upon just one advisor. Use a team of professionals—an attorney, an accountant and a financial professional—to help you work toward your financial goals.

The first step to becoming financially independent is to make the decision to take control of your finances and work toward financial fitness. Then, together with your professionals advisors, develop a strategy that’s right for you. Make adjustments as things change, and don’t give up.

Investments are subject to market risk, will fluctuate and may lose value. Wendy Baum offers securities through AXA Advisors, LLC, member FINRA, SIPCand offers insurance and annuity products through an affi liate, AXA Network, LLC and its subsidiaries.