Glenview nurse Shelley Wax, 53, unexpectedly found herself in charge of her household finances when her husband unexpectedly passed away last June.

With the help of her family’s long-time financial planner, RBC Wealth Management advisor Jeffrey Simon, Wax underwent a “money makeover.”

“I was always involved, but my husband was the numbers guy,” Wax says.

The problem: Since Wax hadn’t been the primary manager of her family’s finances, she had to start at square one—finding passwords to online accounts and understanding her investments.

The fix: Fortunately, Wax already had an established relationship with Simon, who could help her access her accounts and make financial decisions. When she took over the money management, Wax says she started meeting with Simon more frequently. “If I didn’t have someone like Jeff, I don’t know how I would have figured out what we had, much less what to do with it,” Wax says. “I’m definitely feeling a little more in control now.”

The problem: When Wax’s husband passed away, she had three-college bound teenagers, so making sure tuition was covered was a concern. “Fortunately, we had started saving for college as soon as the kids were born with the Bright Start College Savings Program,” Wax says.

The fix: Since the Wax family had college savings and life insurance proceeds that could be earmarked for tuition, Simon advised Wax to stop contributing to college accounts to preserve cash for other expenses.

The problem: Wax works as an RN, but her husband had been the primary wage earner. “It was going to be a big loss of annual income,” Simon says.

The fix: To generate more income for the Wax family, Simon restructured their investments. “We took a portion of the portfolio and went into U.S. dividend-paying stocks, and we took some of the insurance proceeds and invested in municipal bonds versus sitting in money market funds or certificates of deposit,” Simon says.

The problem: When it comes to investing, Wax has a lower risk tolerance than her husband had.

The fix: “[Jeffrey Simon] has helped me understand some of my options that are safer,” Wax says. To create a less-risky investment portfolio that wouldn’t keep Wax up at night, Simon says they moved money out of U.S. small- and mid-cap stocks and international equities. “As we move forward and as Shelley becomes more knowledgeable and comfortable, we may make adjustments,” Simon says. “We thought it would be best to try to reduce the volatility until we can begin to look longer term.”

After a year in the driver’s seat, Wax says investing will never be her passion, but she says: “It’s empowering to know we’re making it through and I’m handling what I need to handle.”

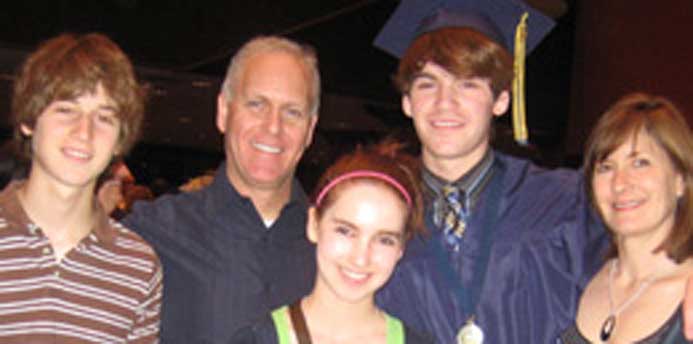

Photo Caption: The Wax family shortly before David’s death.